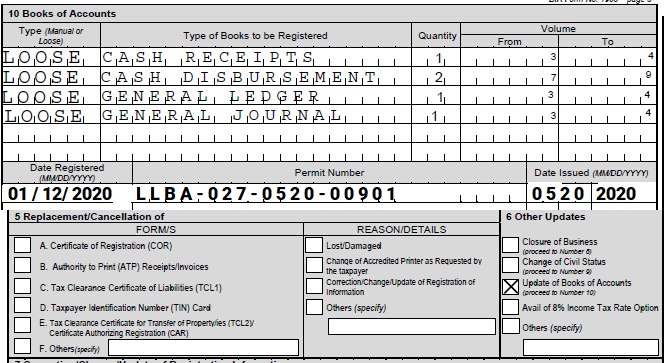

Taxpayers with taxable year ending December 31 2021 and with Permit to Use PTU loose-leaf books of accounts need to present their permanently bound loose-leaf books and other accounting records for taxable year 2021 to their respective BIR office where the Head Office or Branch is registered on or before 15 days after the end of each taxable year January 17 2022. The commissioner of internal revenue has issued revenue memorandum circular rmc no.

Updated Guidelines On Ptu Loose Leaf Filing Grant Thornton

New to this rule are the registering of the books of accounts set prior to the deadline of filing the quarterly or annual income tax return and the examination of books if gross sales or earnings exceed the VAT threshold which is P300000000 within the year.

. Below is a comparison of the three types under 5 categories where well see that among the three loose leaf books of accounts is the best option. Letter of request to. Another thing is that you can Loose Leaf method along with the manual method.

All taxpayers are required to preserve their books of accounts including subsidiary books and other accounting records for a period of ten 10 years reckoned from the day following the deadline in filing a return or if filed after the deadline from the date of the filing of the return for the taxable year when the last entry was made in the books of accounts. An affidavit must also be submitted confirming the type of books the number of pages. Filing of Loose-Leaf Books 15 January 2022 Most businesses in the Philippines will register for Manual Books of Accounts when they first register their business whether its a corporation OPC or sole proprietorship.

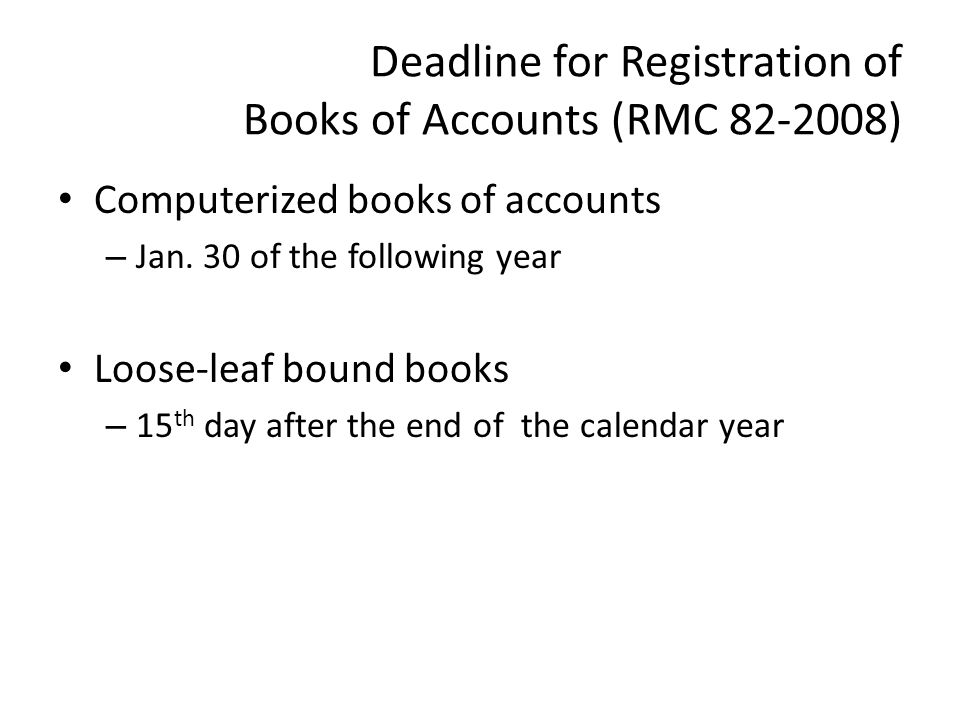

These books must be submitted on or before 15 January 2021. Deadline of submission is on or before January 15 of the next calendar year. Loose Leaf method simply uses an excel template while Computerized Books of Account method will require you to use an approved computerized accounting program.

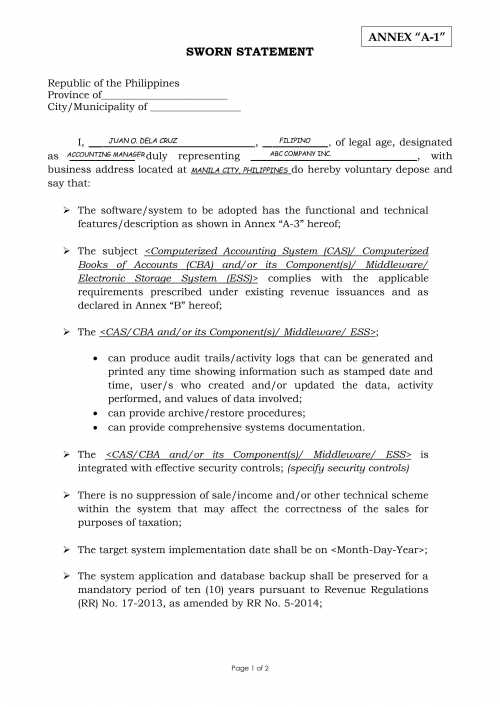

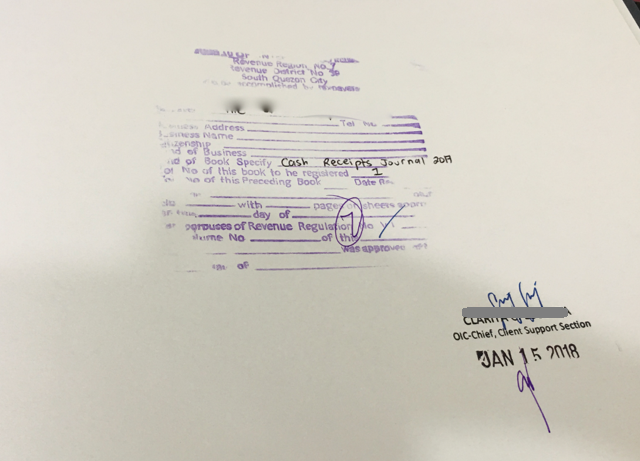

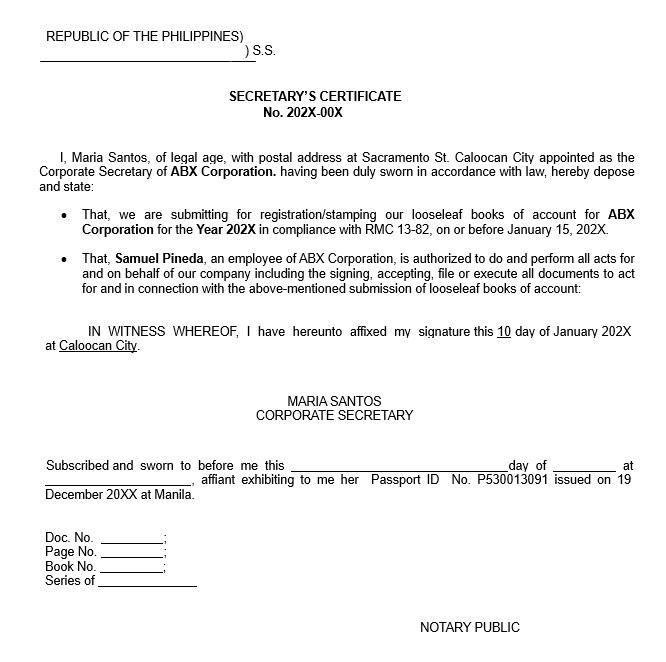

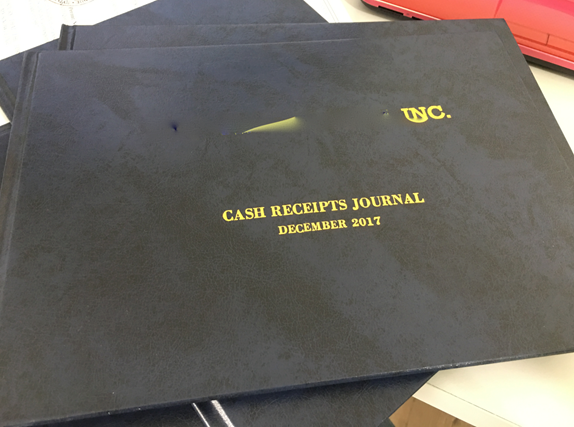

An affidavit attesting the completeness accuracy and correctness of entries in Books of Accounts and the number of Loose Leaf used for the period. 68-2017 August 10 2017 This Tax Alert is issued to inform all concerned on the new venue for filing the application for Permit to Use PTU loose-leaf book of accountsinvoicesreceipts and other accounting records. BIR will usually ask you to have the loose leaf book bound.

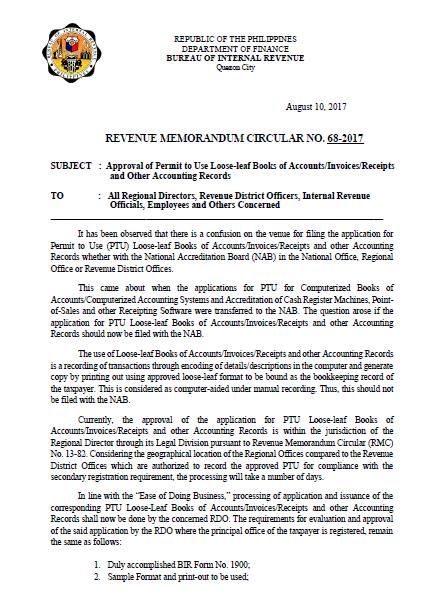

According to Revenue Memorandum Circular RMC No. Computerized Books of Accounts For BIR approved computerized books taxpayer must submit to the BIR in CD-R DVD-R or other optical media for the taxable year on or before January 30. Revenue Memorandum Circular No.

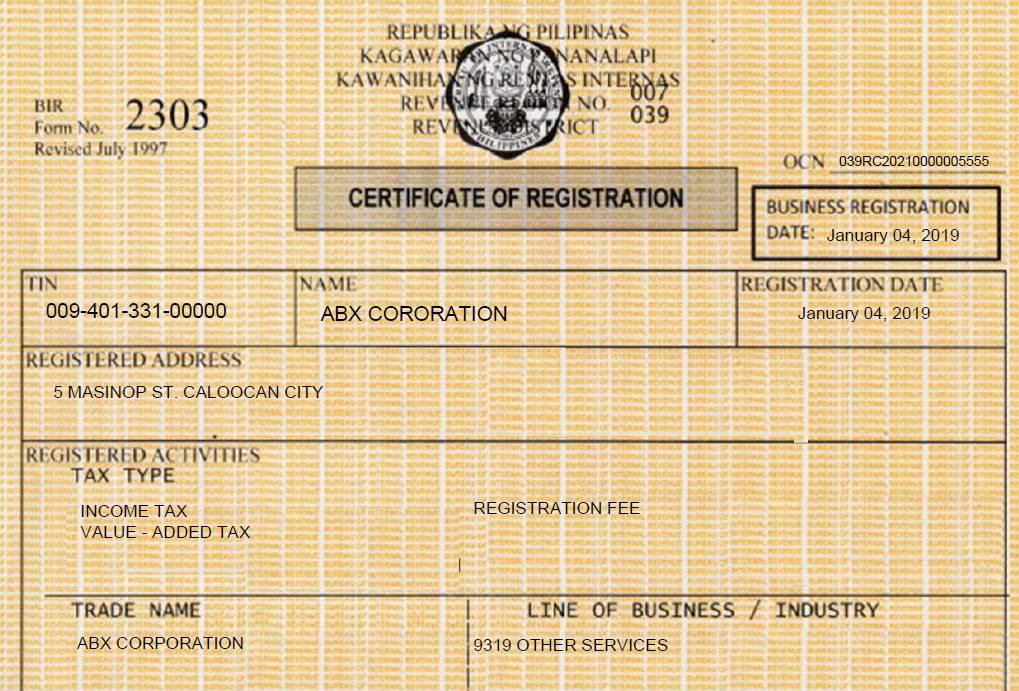

Loose-leaf Books of Accounts. REVENUE MEMORANDUM CIRCULAR No. To apply for BIR Loose Leaf a company must initially apply for a Permit to Use PTU Loose-leaf books of accounts with the BIR.

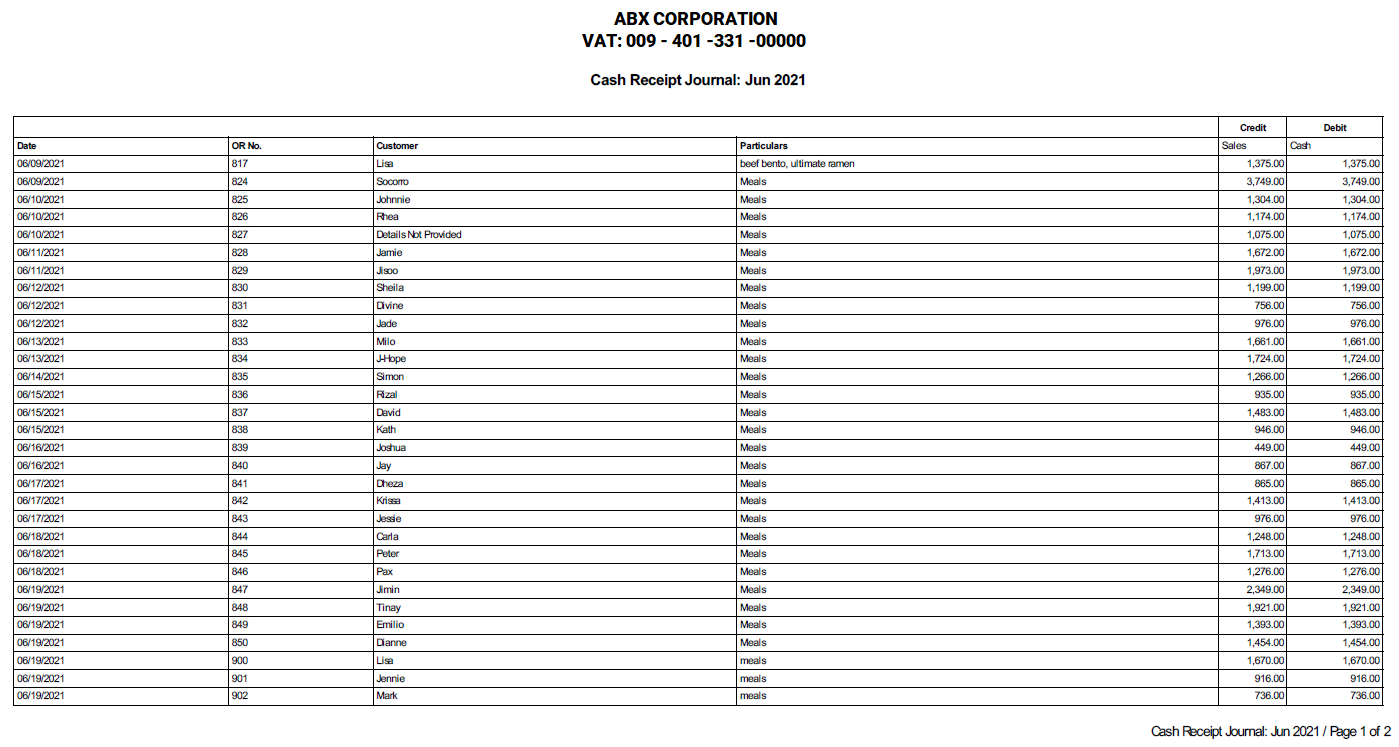

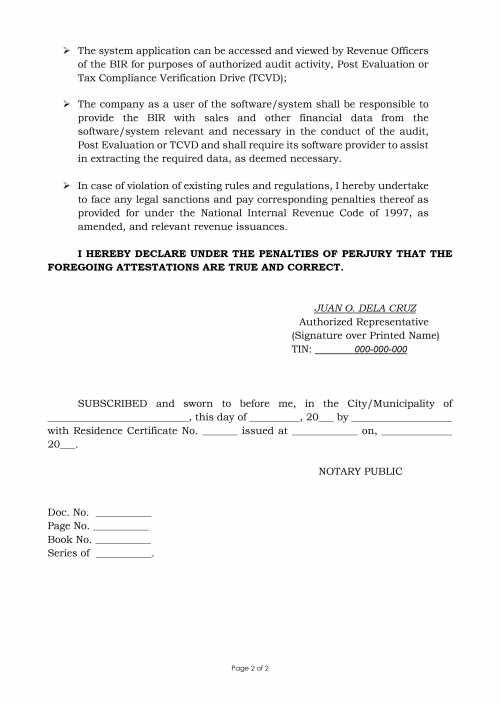

As stated earlier Loose-leaf books are manual books of accounts where entries are typed in a computer and printed out for filing. Computerized Booking however would require you to have the supplier of the system to be BIR accredited along with a DBS examiner to validate the computer system. 68-2017 dated 10 august 2017 the circular to clarify the confusion on the venue for filing the application for permit to use ptu loose-leaf books of accountsinvoicesreceipts and other accounting records whether with the national accreditation board.

Registration of permanently bound computer-generatedloose leaf books of accounts and other accounting records. REGISTRATION of Bound Loose Leaf Books of AccountsInvoicesReceipts Other Accounting Records - CY ending Dec. SUBMISSION of List of Medical Practitioners CQ ending Dec.

Computerized Books of Accounts. Special Power of Attorney in case the business owner will not apply personally. Loose leaf Books for Calendar Year January 1 2021 to December 31 2021 are due for submission on or before January 15 2022.

Newly registered taxpayers shall present the manual books of accounts to the RDO or concerned office under the Large Taxpayer Service where the place of business is located for approval and registration before the deadline for filing of the first quarterly income tax return or the annual income tax return whichever comes earlier. Late payment of LBT is automatically penalized with a 25 surcharge on the base taxes fees or charges while an additional 2 monthly interest will be charged on the basic amount and the 25 surcharge. SUBMISSION of Notarized Income Payees Sworn Declaration of Gross ReceiptsSales with required.

Tax Calendar - May Tax Calendar. The deadline for the renewal of registration and payment of LBT in all cities and municipalities is on the 20th of January each year. If the deadline falls on a weekend or holiday the deadline will be moved to the next working day.

Permanently bound Loose Leaf Books of Accounts. After your application is approved you will received Permit to Use PTU Loose-Leaf Books of Accounts. Any business that maintains its accounting books via the loose-leaf books of accounts system is required to submit BIR approved accounting books and records for the year ending 31 December 2020.

Meanwhile application for PTU Loose-Leaf is currently under the. The circular is set below. Commitment to permanently bind the loose-leaf forms within fifteen 15 days after the end of each taxable year or upon the termination of its use.

Registration of manual books of accounts can take less than an hour loose leaf around a day and then for a computerized accounting system the registration can take at a minimum six 6 months. In line with the ease of doing business. This is generally the default type of registration for the Books of Accounts in the Philippines.

68-2017 Loose-leaf book is still manual event if it is created and printed using a machine. Updated guidelines on PTU loose-leaf filing. Loose-leaf Books of Accounts For BIR approved loose-leaf books taxpayer must submit to the BIR bounded books of account for the taxable year on or before January 15.

BIR Tax Deadline 15 Thursday REGISTRATION of Bound Loose Leaf Books of AccountsInvoicesReceipts and Other Accounting Records - Fiscal Year ending September 30 2020 SUBMISSION of List of. Registration of computerized books of accounts and other accounting records together with affidavit attesting the completeness of the computerized accounting booksrecords January 30 or 30 days after the end of the fiscal year. These books must be filed on or before 15 January of the following year.

Bound Loose Leaf Books of AccountsInvoicesReceipts Other Accounting Records Fiscal Year ending May 31 2021 SUBMISSION Monthly Summary ReportSchedule of Transfers. 15 Thursday REGISTRATION of Bound Loose Leaf Books of AccountsInvoicesReceipts and Other Accounting Records - Fiscal Year ending.

What You Need To Know About Books Of Accounts Beyond D Numbers Consulting Co

Registration Bookkeeping Invoicing Ppt Download

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Insider Tip Preparing Your Books Of Accounts For Business Permit Renewal Audit Fullsuite

Loose Leaf Books Of Accounts Annual Submission

Formats Of Books Of Accounts Explained

Bureau Of Internal Revenue Revenue District Office No 113 Davao City Ppt Video Online Download

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts 2022 Filing

Permit To Use Loose Leaf Books Of Accounts Reliabooks

Loose Leaf Books Of Accounts Annual Submission

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Loose Leaf Books Of Accounts Annual Submission

Loose Leaf Books Of Accounts Annual Submission

Permit To Use Loose Leaf Books Of Accounts Mpcamaso Associates

How To Apply For Bir Loose Leaf Qne Software Philippines Inc

Masyadong Bang Marami Ang Transactions Mo Monthly At Halos Sa Maubos Na Ang Oras Mo Sa Pag Bobookkeeping Manually Every Month Apply Na For Loose Leaf Bookkeeping Check Here The Steps On How